Guyana President announces removal of VAT in several sectors

Guyana’s President Mohamed Irfaan Ali announced the removal of Value Added Tax (VAT) in several sectors — a fulfilment of the promise made by the Peoples’ Progressive Party/ Civic (PPP/C) during the election campaign

The President said that the measure will bring relief, stimulate economic activity, increase the country’s productive capacity, reduce the cost of doing business and facilitate the growth and development of businesses. The measures, President Ali said will have an immense impact on people’s welfare and well-being and improve living standards.

Ali added that the measures will help every aspect of life and “put more money in people’s pocket.”

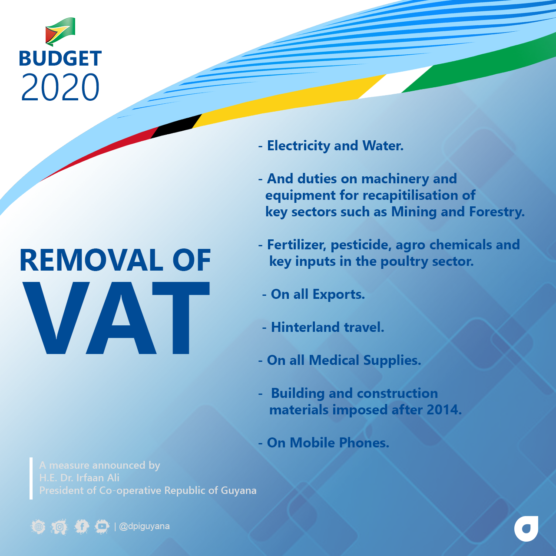

VATs to be removed

Topping the list is the removal of VAT immediately on water and electricity introduced by the previous administration.

Removal of VAT and duties will also be imposed on machinery and equipment to allow for the recapitalization of key sectors which includes mining, forestry, agriculture and manufacturing. This is coupled with the granting of tax concessions for mining, forestry, manufacturing and agriculture.

There will also be the reversal of land lease fees that we have had over the last five years, back to the position it was in 2014. The President said that one of the reasons for this is due to the increase in land lease fees for poultry by 1350 percent. Value Added Tax will also be removed on agro-chemicals, fertilizers, pesticides and key inputs in the poultry sector.

The Head of State also highlighted that there will be a reversal of VAT on all exports. He noted that this will help the manufacturing sector, help exporters to become more competitive and profitable that could lead to creating more jobs and new opportunities.

VAT on hinterland travel, all medical supplies, building and construction materials and cellular phones are likewise to be scrapped. Further, corporate tax on private education and private healthcare will be removed.

Other relief measures

Apart from removel of VAT, President Ali also said that mortgage interest relief will be increased to $30 million and will be income tax deductible.

“This will help new homeowners, this will help young people where your loans for housing are up to $30 million, the interest from those loans will become income tax-deductible.”

Also, low income loans have now been increased to $10 million from $8 million.

Ali also announced that all licenses fees which were increased before October 1, 2020, will be slashed by 50 per cent.

There will also be a change in the log export policy to allow saw millers to export logs, easing the burden of small loggers and saw millers.